China’s Gold Rush

China is currently the world’s biggest gold consumer, purchasing and storing tens of billions of dollars of the metal each year. So what does this mean for the price of gold and the future of the metal?

Reports have also recently surfaced that China has given domestic and international banks permission to import large amounts of gold into the country, an act that will likely have a positive effect on gold prices worldwide.

The only economy to have grown during 2020 was China’s, which has ushered in their booming demand for gold jewelry, bars and coins. This rebound has driven local prices above the global benchmark.

Gold is now selling at a premium of $7-9 an ounce in China; a number that would be even more inflated had importing the precious metal been halted.

Beijing has also given the green light on gold imports where 150 tonnes worth $8.5 billion is likely to be shipped. They will import gold from Australia, South Africa and Switzerland.

Gold-Backed Yuan

In 2018 China launched a gold-backed, yuan-denominated oil futures contract with the contracts priced in Yuan but convertible to gold. Many thought, “the rise of the petroyuan could be the death blow for the dollar.”

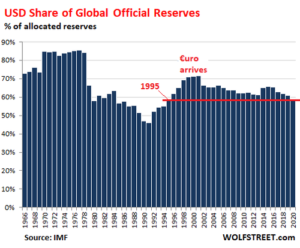

Two weeks ago, The IMF published a report showing US-dollar-denomiated exchange reserves dropped to 59% in the fourth quarter. Matching the 25-year low of 1995.

China also just became the first major economy to unleash a Central Bank Digital Currency, “cementing its trailblazer status in virtual currencies far ahead of other countries, after already recently experimenting with large-scale trials of actual payments by consumers, which was met with mixed results.”

The effect of this is even more surveillance, and loss of privacy for its citizens. China is not shy about its desire to know every move of those who live within its borders and this is another cementing move on their part.

A Chinese financial weapon?

Peter Thiel, the Found of the ground-breaking company Palantir, also recently warned Americans to be weary of digital currencies, especially Bitcoin. Thiel stated, Bitcoin should also be thought [of] in part as a Chinese financial weapon against the US… It threatens fiat money, but it especially threatens the U.S. dollar.”

Is this why China is buying gold? To hedge against the dollar as the reserve currency of the world…?

It’s no secret the price of gold will skyrocket in the near future with the effects of the lockdown slowly creeping up on us. The effects have been mitigated by the Federal Reserve’s endless printing of money that will first lead us into a depression (meaning stagnant growth) and then inflation; all the while cementing gold as the wealth preserving asset it has always been.

China is taking action based on the declining value of the dollar and inevitable inflation coming in the next 24 months. Solidifying the sentiment, Reuters reported that China has given domestic and international banks permission to import large amounts of gold into the country,

The People’s Bank of China (PBOC), the nation’s central bank, controls how much gold enters China through a system of quotas given to commercial banks. It usually allows enough metal in to satisfy local demand but sometimes restricts the flow.

In recent weeks it has given permission for large amounts of bullion to enter, the sources said.

“We had no quotas for a while. Now we are getting them … the most since 2019,” said a source at one of the banks moving gold into China.

Around 150 tonnes of gold worth $8.5 billion at current prices is likely to be shipped, four sources said. Two of the sources said the bullion would be shipped in April. Two others said it would reach China over April and May.

Obviously this news sent gold prices higher, shown in the graph below.

The size of the shipments is a clear signal to the world that China is back in the global bullion market. They’ve seen the writing on the wall for the USDollar as the global reserve currency, and they’re taking action.

…..are they paving the way for a gold-backed yuan?

Perhaps Peter Thiel is right… and bitcoin is the trojan horse to attack the dollar and make way for a gold-backed yuan?

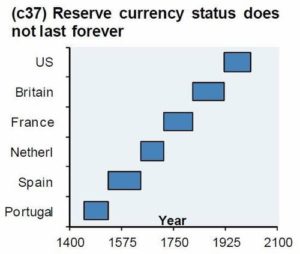

Reserve currency status can’t last forever.