Jerome Powell announced during Wednesday’s press conference, the Fed will indefinitely welcome inflation. This historic experiment comes in the wake of an economy that is already overheating and artificially propped up, as we discussed in yesterday’s article. Yet, this is not stopping the Fed from doing the unprecedented: throwing lighter fluid on our highly flammable economy.

The rationale behind this decision is their idea inflation will return to normal in a few years, before 2023 when their rates will be at zero.

Federal Open Market Committee Members (FOMC), whom are independently wealthy, can charge away purchases to their Fed card on day-to-day activities. It seems this is why inflation holds little weight in their decision making processes. The rest of the population does not hold this same luxury and must therefore pay and care about highly inflated prices, which crush the purchasing power for Americans.

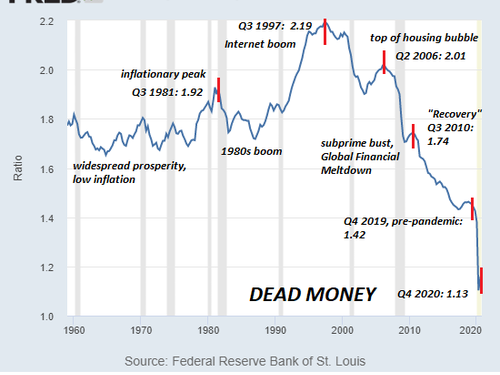

Our money is already dead. It holds a fraction of the purchasing power it has in previous decades, and the velocity of money, which few talk about, has completely collapsed. The velocity of money refers to the amount of times money changes hands over a period of time.

The Velocity of Money

“The velocity of money is the frequency at which one unit of currency is used to purchase domestically produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. A decreasing velocity might indicate fewer consumption transactions are taking place.”

If I pay the dog groomer, and tip her, and she takes the tip and goes and buys a coffee, the velocity of money in this scenario is two. The stark reality now is this velocity has dropped from 2.2 in the 80’s down to under 1.2 in 2020.

While the money supply has gone up 12-fold in the U.S. in this same time period. With the endless printing of money to offset our massive national debt, the velocity has plummeted. This means less transactions and less spending with more money.

This is how money dies.

Current State the U.S. Economy & Supply Chains

CIO of Bank of America explained in a recent notification to a California real estate developer, the following anecdote,

“Our worldwide supply chain, and ability to provide products and services to you, is being significantly impacted by increased prices resulting from labor and raw material shortages, escalating raw material prices, manufacturing delays and transit interruptions. Stated directly, our costs are increasing and are much more volatile than in the past.” – Mar 3rd price increase notification to CA real estate developer.

The most recent mfg ISM article precisely explains the state of worldwide shortages and more:

- “Things are now out of control. Everything is a mess, and we are seeing wide-scale shortages.” (Electrical Equipment, Appliances & Components)

- “Supply chains are depleted; inventories up and down the supply chain are empty. Lead times increasing, prices increasing, [and] demand increasing. Deep freeze in the Gulf Coast expected to extend duration of shortages.” (Chemical Products)

- “The coronavirus [COVID-19] pandemic is affecting us in terms of getting material to build from local and our overseas third- and fourth-tier suppliers. Suppliers are complaining of [a lack of] available resources [people] for manufacturing, creating major delivery issues.” (Computer & Electronic Products)

- “We have seen our new-order log increase by 40 percent over the last two months. We are overloaded with orders and do not have the personnel to get product out the door on schedule.” (Primary Metals)

- “Prices are rising so rapidly that many are wondering if [the situation] is sustainable. Shortages have the industry concerned for supply going forward, at least deep into the second quarter.” (Wood Products)

- “We have experienced a higher rate of delinquent shipments from our ingredient suppliers in the last month. We are still struggling keeping our production lines fully manned. We anticipate a fast and large order surge in the food-service sector as restaurants open back up.” (Food, Beverage & Tobacco Products)

- “Steel prices have increased significantly in recent months, driving costs up from our suppliers and on proposals for new work that we are bidding. In addition, the tariffs and anti-dumping fees/penalties incurred by international mills/suppliers are being passed on to us.” (Transportation Equipment)

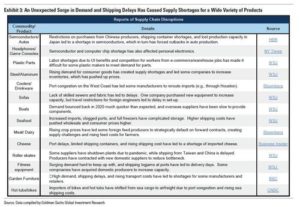

A Goldman Sachs report also summarizes the effects of these disruptions:

So, What’s Next for the U.S. Economy?

The simultaneous expansion of money and collapse of money velocity, along with supply and demand chain shortages, lead to a Dead Money Economy. The money being created is now either spent overseas or saved in accounts rather than exchanging hands for goods and services in the U.S.

This thin string of security we’re holding onto is losing its strength.

While the Fed would like us to believe all is business as usual, Americans know the reality. Money is being printed, loses its purchasing power by the day, and is essentially “dead money.”

As many have warned, metals will be returned to as the main form of currency. It is then and only then we will have a financial institution based on something rather than our declining, dead, fiat currency. For a guide on metals as currency, and what’s to come, click here.